June 12, 2024 by Cyril Noirot

From travel to finance: How Airbnb leverages guest payments

Forget booking fees and travel trends, there’s a new moneymaker quietly fueling Airbnb’s growth: its lucrative interest income stream. While most focus on Airbnb as a travel platform, the company has been strategically leveraging its role as the middleman to generate significant returns.

What is interests income ?

Interest income is money earned by an individual or company for lending their funds, either by putting them into a deposit account in a bank or by purchasing certificates of deposits.

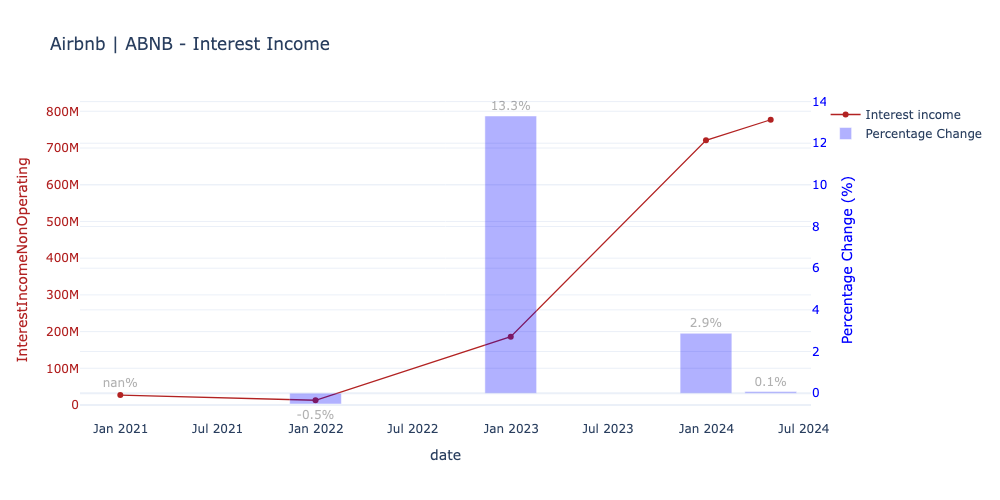

AirBnB| ABNB interests income

The interest income for AirBnb shows a growing and general upward trend to reach 777M$ in July 2024.

In July 2022 there is massive spikes, 13.3% change which might be associated with bold strategic financial decisions, such as reallocating assets to higher-yielding accounts or other income-generating financial instruments. Good to notice this happend directly after the covid period.

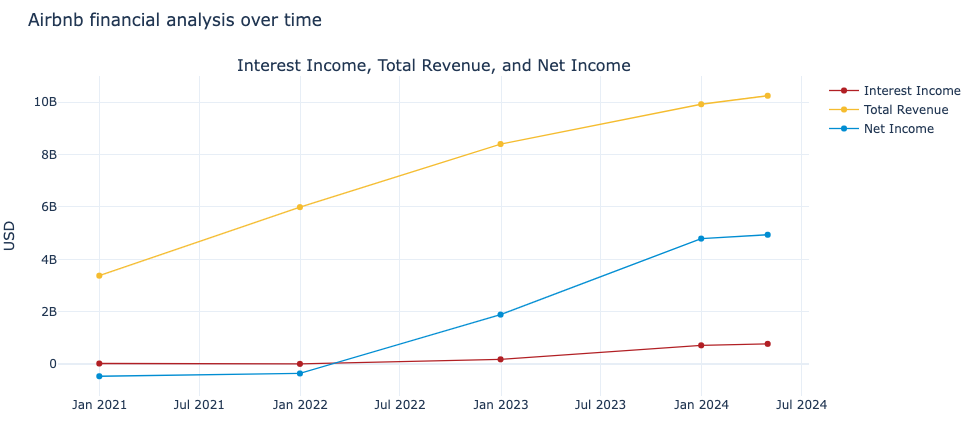

Let’s now compare these values to some key financial values:

TotalRevenue: The total earnings from Airbnb’s operations before any expenses are subtracted.NetIncome: The profit remaining after all expenses, including taxes and interest, have been deducted from total revenue.

by computing the following ratio:

interestIncome_per_revenue: Ratio of interest income to total revenue, expressed as a percentage.interestIncome_per_netIncome: Ratio of interest income to net income, expressed as a percentage.

Analysis

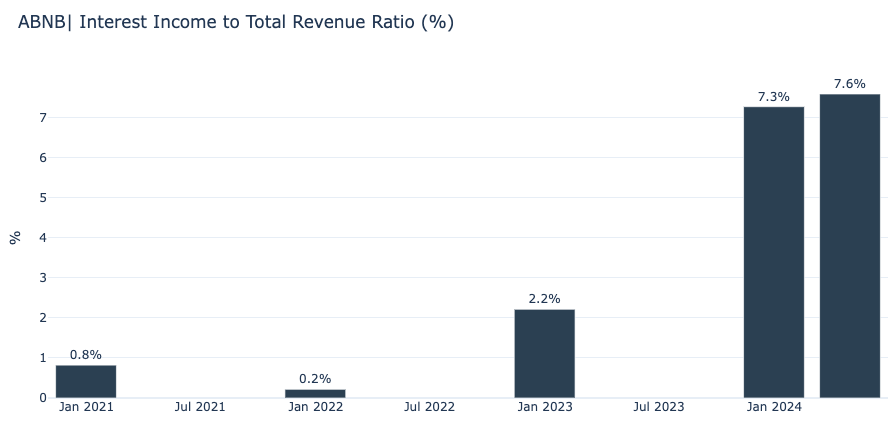

Interest income to revenue ratio

2020-12-31: Very low at 0.8207%, indicating that the non-operating interest income constitutes a very small portion of total revenue. This suggests that the main revenue streams are strongly focused on core business activities which is home rental.

2021-12-31: An even lower ratio of 0.21696% further stresses this point, also explained by the COVID19.

2022-12-31 to 2024-04-30: The ratio increases significantly each year, reaching 7.58715% by April 2024. This trend indicates that either the interest income is growing faster than the total revenue, or Airbnb has found more efficient ways to generate interest income. My guess is after the pandemic people the rate of rental booking have boomed leading to much more dispoable revenue.

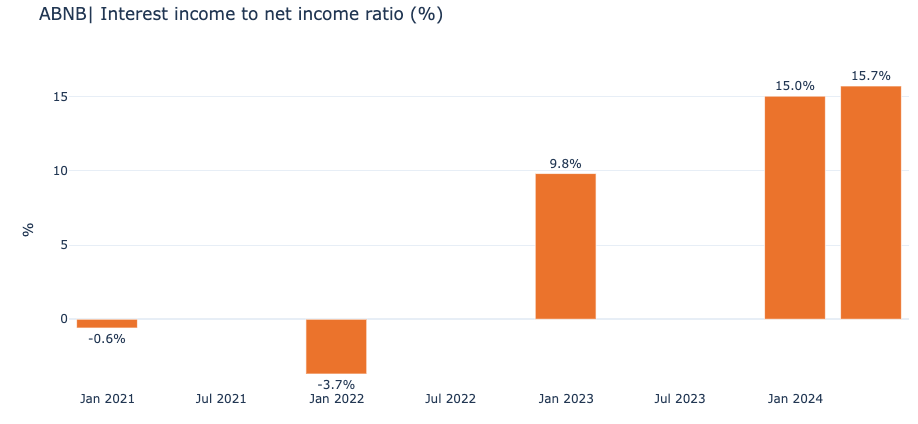

Interest income to net income ratio

There’s a dramatic shift with this ratio skyrocketing to 15.7% by April 2024. This substantial increase could imply that either net income has decreased while interest income increased, or Airbnb has significantly improved its profitability and cash management.

Conclusion

The improving ratios in the later years is a positive sign, reflecting better financial health and management’s effective use of assets to generate additional income. However, the dependency on non-operating income to bolster financial figures is also a risk factor that needs to be monitored.

The growing proportion of interest income relative to both total revenue and net income suggests Airbnb may be accumulating larger cash reserves, possibly due to improved cash flows from operations, which are being effectively managed to generate additional income through interest. It could also indicate strategic financial management decisions, like investing in higher-yield financial instruments or more conservative cash management in a possibly volatile market such as Treasury bills.